Disclaimer: this article is Original published by Machinery Intelligence Station.

Sources: https://mp.weixin.qq.com/s/B0FrAKf_QCkMQ_DxWyOM-w

Manufacturers from China and other Russia-friendly countries have not only replaced companies that have exited the market but also increased import volumes, laying a good foundation for a competitive environment. New brands from India and Turkey are emerging, while parallel imports continue. (Reported by Russian Construction Equipment Site)

Summary of Content:

• Chinese manufacturers dominate the imported heavy machinery market in Russia.

• Indian manufacturers have entered the top five suppliers of crushers and bulldozers.

• European brands continue to enter the Russian market through parallel imports, albeit in limited volumes.

Andrei Lovkov, the commercial director of Russia’s ID-Marketing company, analyzed the import structure of the Russian heavy machinery market at the “Real Mining 2024” forum, a market that has been operating under sanction pressure for three years.

Adaptation to the New Environment in the Excavator Market

Specialists explored the state of the mining machinery market through an analysis of the main equipment categories. In the field of heavy excavators, he divided it into two sub-markets. The first is heavy excavating machinery weighing 33 tons and above, a sub-market that, despite a marked reduction in supply in the first half of 2024, still occupies the largest share of mining machinery.

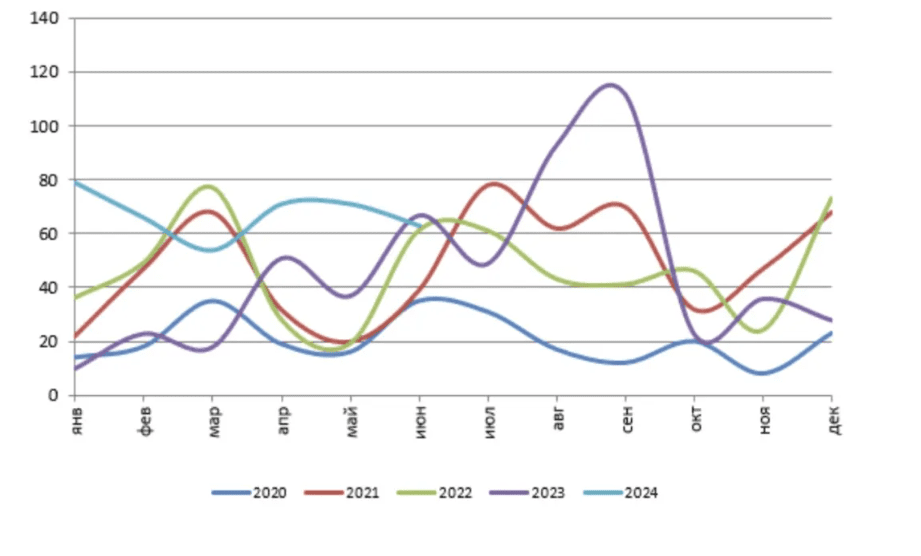

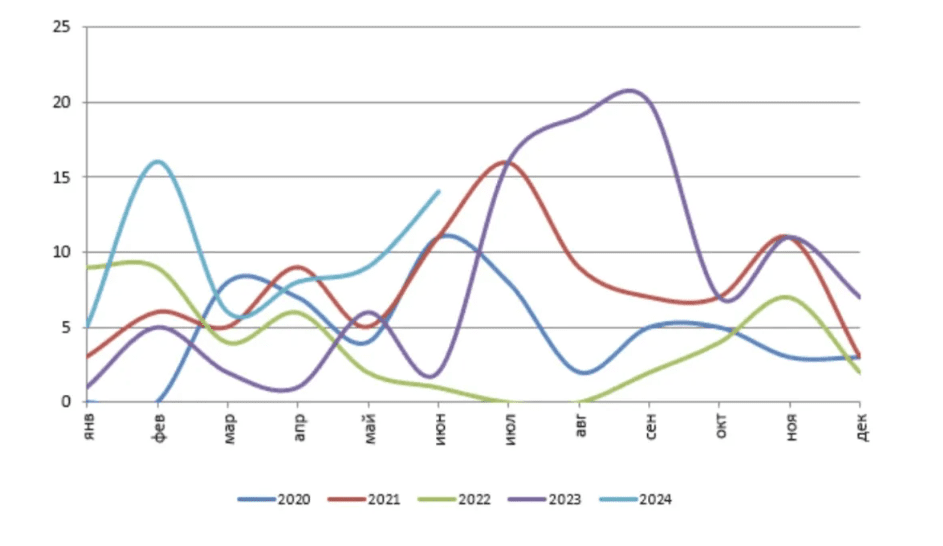

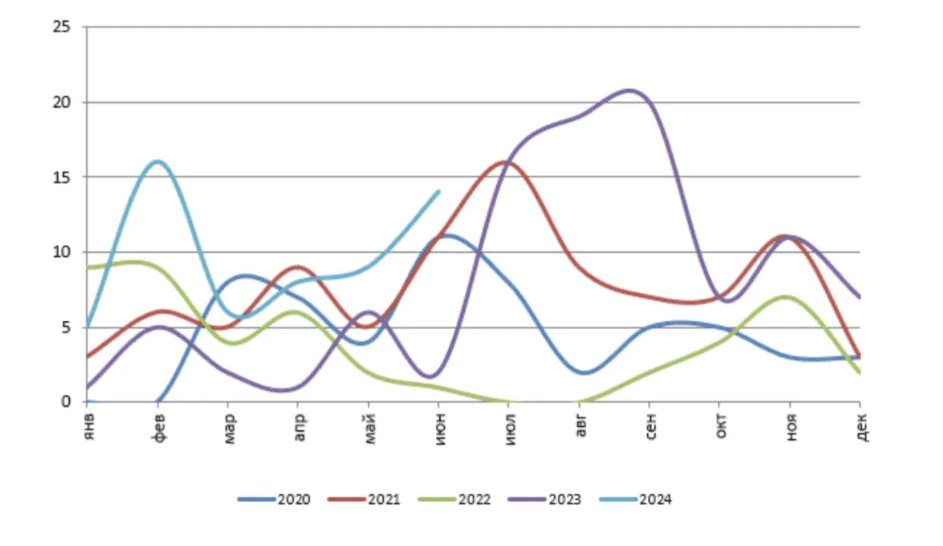

Data on Heavy Excavator Imports

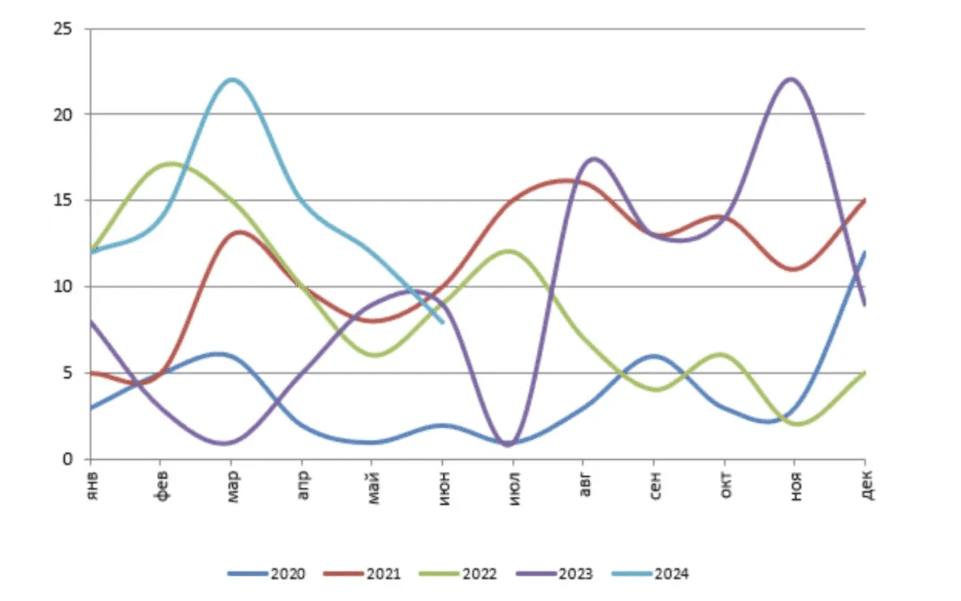

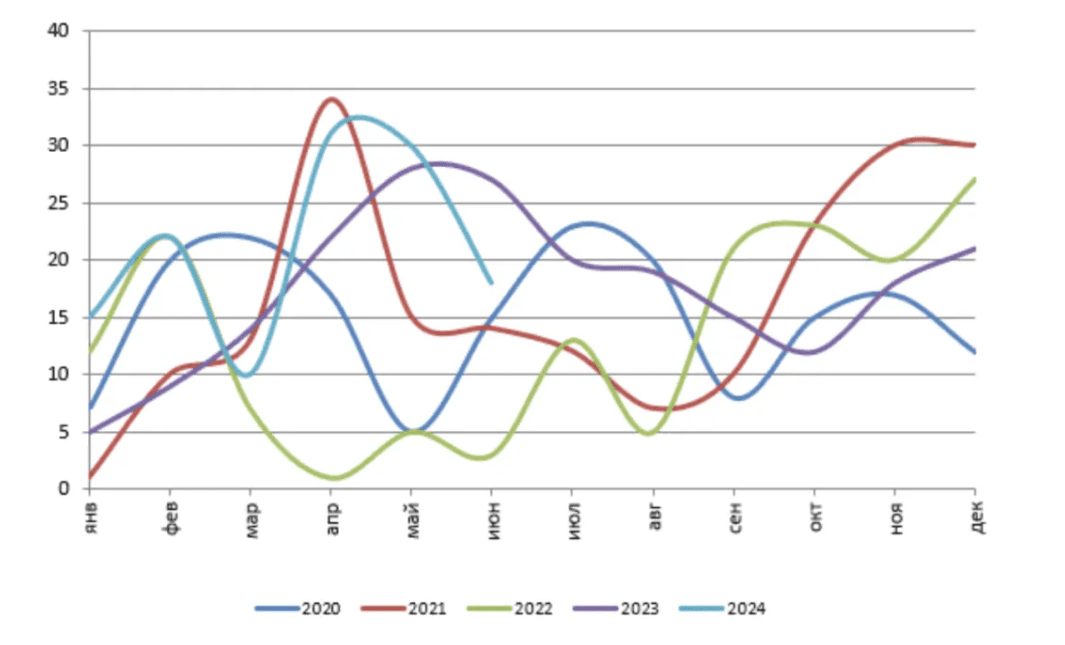

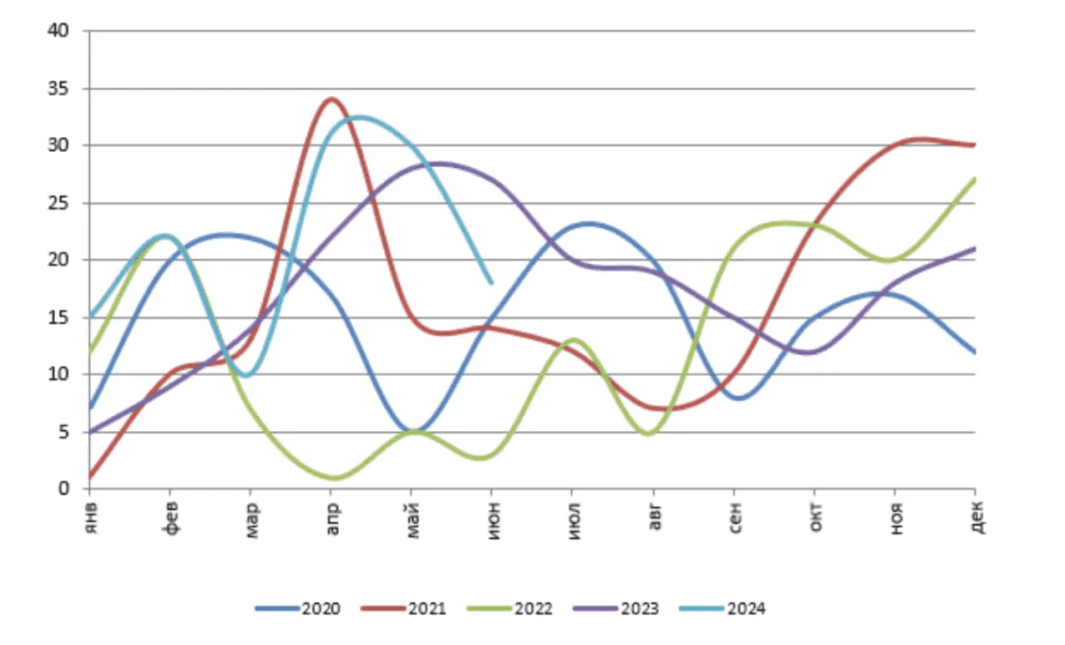

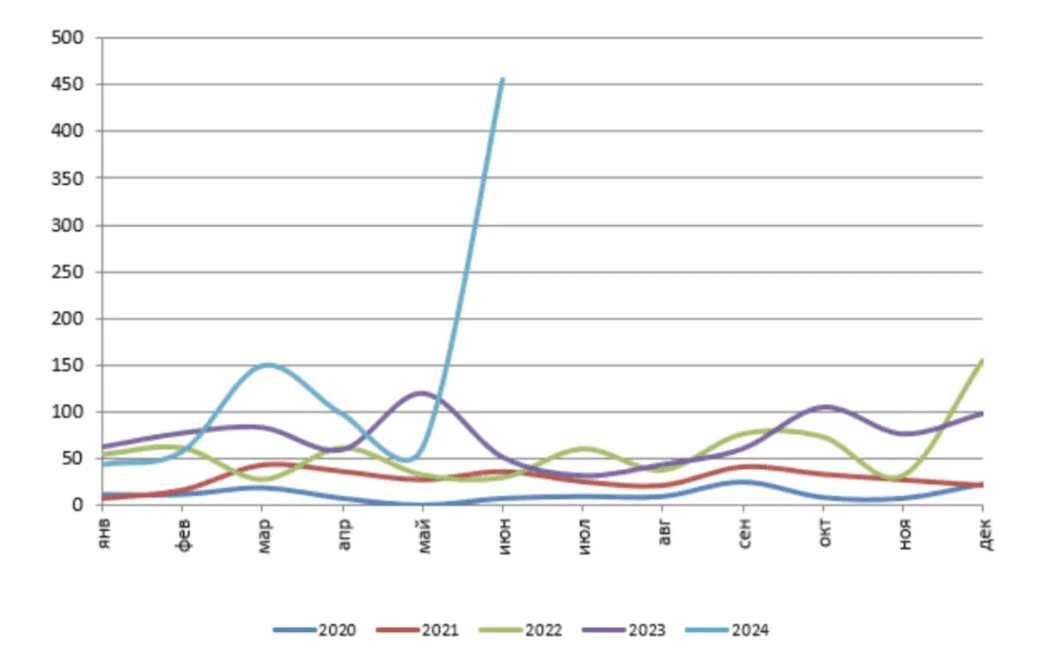

“The market decreased by 27% during the pandemic year, but then we saw a steady increase in import volumes over the next three years. There was more than a twofold increase in 2021, a 54% increase in 2022, and a 30.4% increase in 2023. This is a very positive trend, particularly considering the high price of such machinery,” noted Andrei Lovkov. “However, by 2024 there was an expected drop, with a 45% decrease in the heavy excavator market.” The second sub-market is large mining excavators weighing over 90 tons. “Given the application features and cost of this kind of equipment, the market size is not massive in number. Adapting to the new environment is not easy,” he added. “From August 2023, machinery from China entered this arena, hence there was a 50% decrease in supply for 2023. Although the number of Chinese machines increased, brands from unfriendly countries remain on the market, meeting certain demands.”

Data on Large Mining Excavator Imports

(Market Share of Brands January-June 2024)

(Import Dynamics from January 2020 to June 2024 — Units/Sets)

Lovkov specifically mentioned that there was a change in the brand structure of the heavy excavator market. In 2021, the top five import brands were Hyundai, Komatsu, Volvo, Doosan, and Caterpillar. After sanctions, these brands significantly reduced their import volumes. Hyundai, in particular, cut its import volume by 53% and ranked third in 2024. “Before 2022, Chinese brands were not among the top five importers, but even among Chinese brands, the situation is changing fast,” Andrei Lovkov added. “Only Shantui achieved a growth in import volume of over 140%; in the first half of 2024, there were 29 brands involved in the heavy excavator market.”

Heavy Bulldozers, India’s BEML Enters the Top Five in the Market

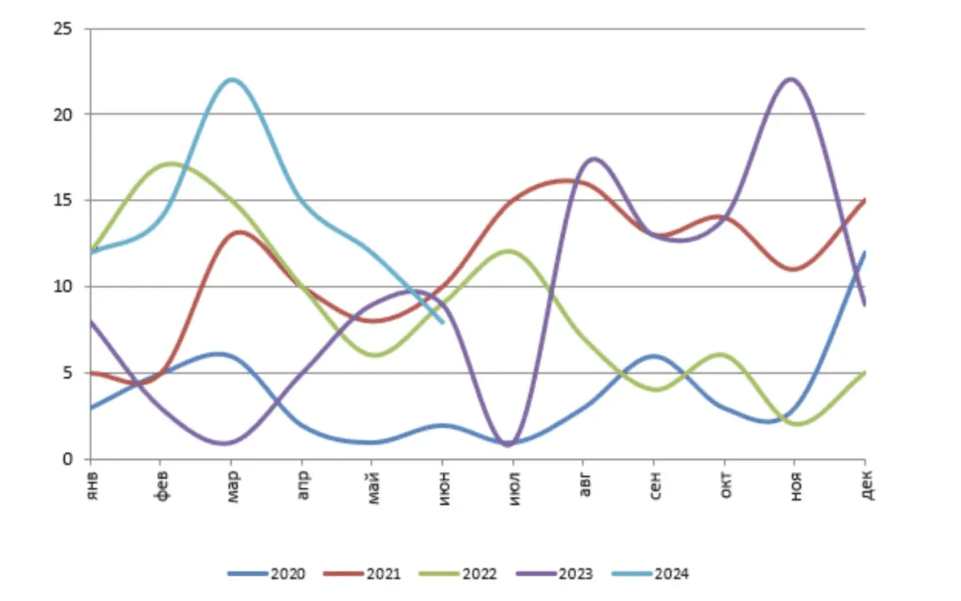

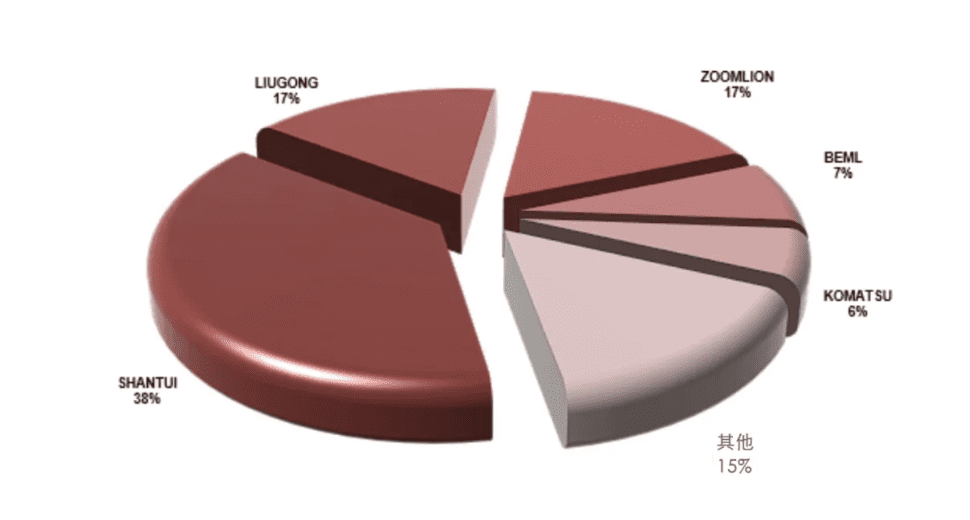

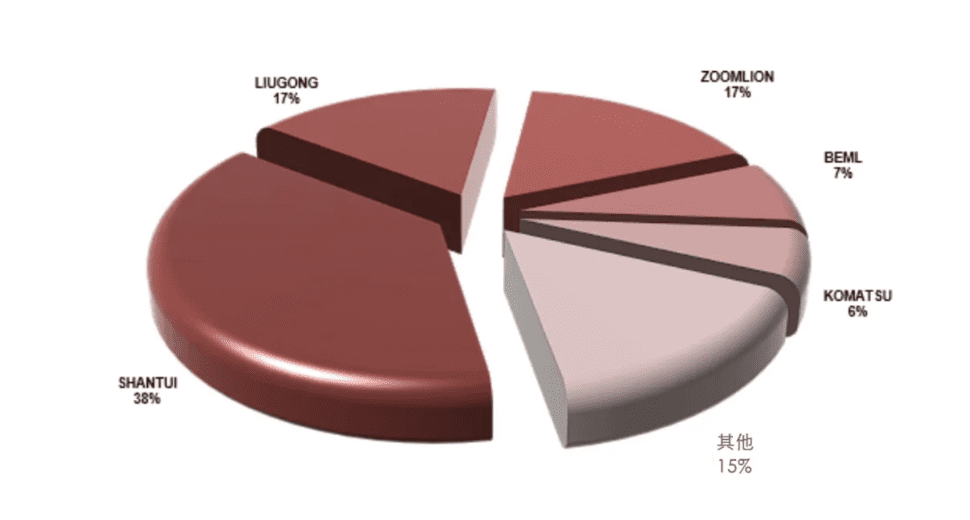

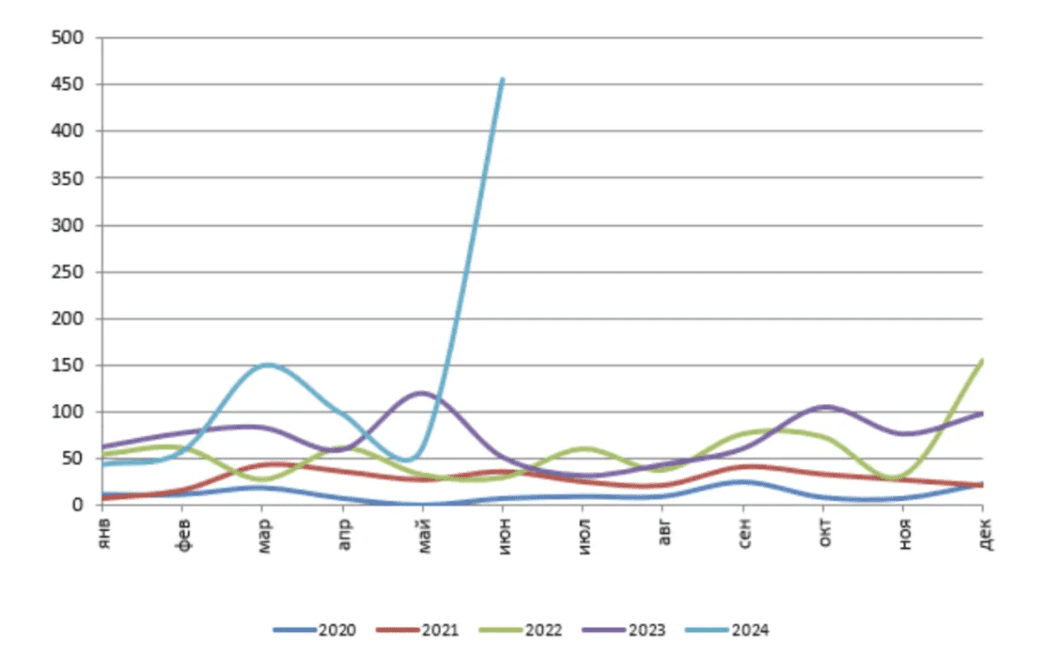

Previously, the heavy bulldozer market was mainly occupied by brands such as Komatsu, Caterpillar, and Liugong. However, since 2022, the activity of Chinese brands in this field has increased significantly. “Shantui was the first to surpass the Western brands.

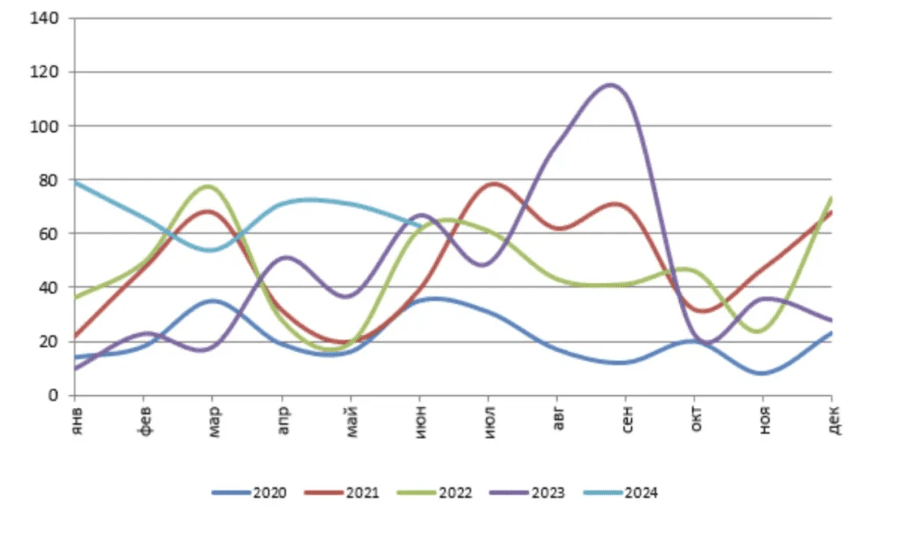

Data on Heavy Bulldozer Imports

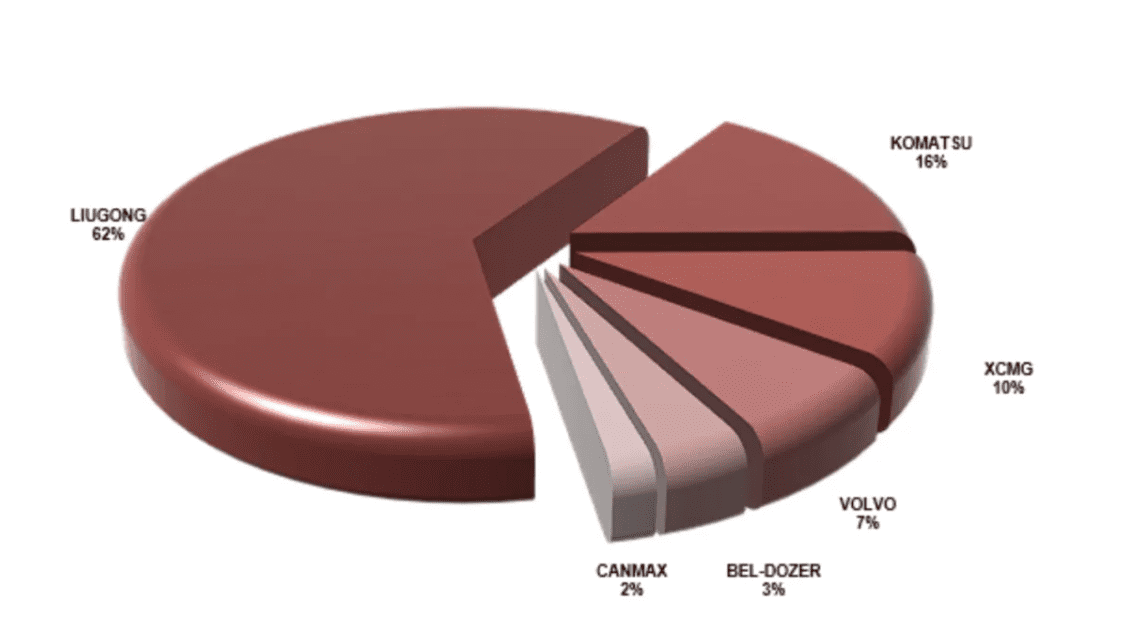

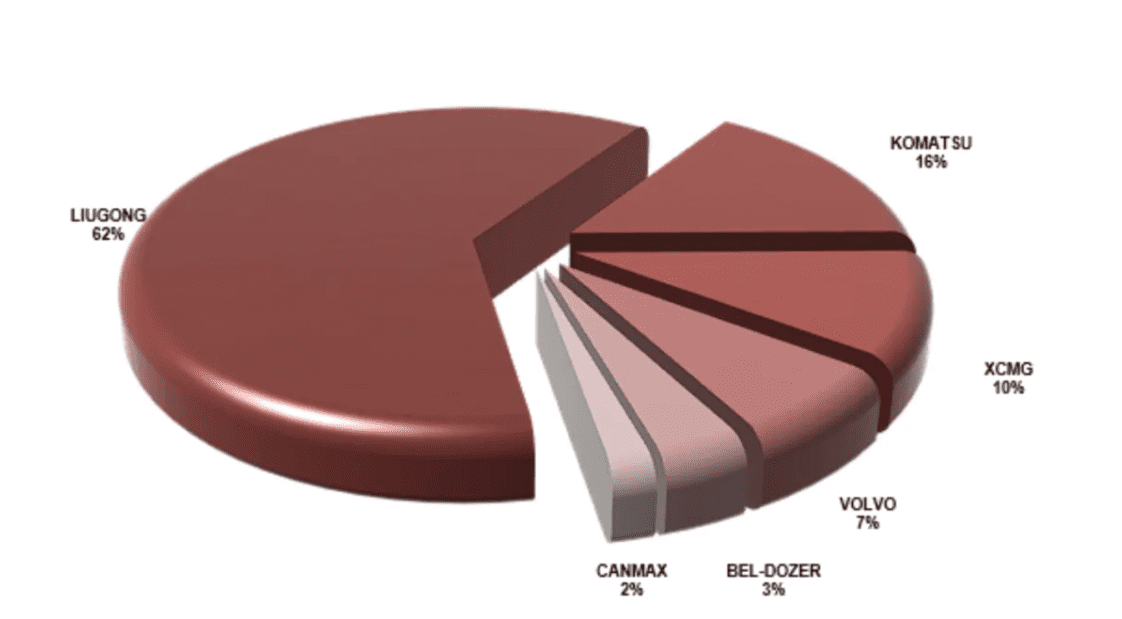

(Market Share of Brands January-June 2024)

(Import Dynamics from January 2020 to June 2024 — Units/Sets)

However, in the first half of 2024, the situation changed again. India’s BEML (Bharat Earth Movers Limited) became a new market participant. In April 2024, BEML began its first supplies of heavy bulldozers to the Russian market, with an import volume that propelled it to fourth place. “India is still an emerging market player in the mining field. But based on the imports of excavators and loaders we are seeing, India will gradually emerge in other areas,” Lovkov believes. “Competition in the Russian mining market will become more intense, with Indian manufacturers also taking part.” Meanwhile, Komatsu also increased its supply in this segment — in the first half of 2024, its import volume of heavy bulldozers in Russia exceeded the total volume for the entire year of 2023. By 2024, there were a total of 21 importers in the heavy bulldozer market.

Heavy Loaders, Japanese Brands Still Influence

The import volume of heavy loaders has been dominated by a few brands for a significant period, including Komatsu, Caterpillar, and Volvo.

Data on Heavy Loader Imports

(Market Share of Brands January-June 2024)

(Import Dynamics from January 2020 to June 2024 — Units/Sets)

“The market showed optimistic performance at the beginning of 2022. Even in January and February (which are not the peak supply season), the market’s activity exceeded previous years. However, there was a dip in March, and almost zero imports in July and August,” said Andrei Lovkov. “There was a lesser supply in the first half of 2023, but the market saw a strong rebound, particularly in the third quarter. In 2023, loader imports doubled compared to 2022.” In 2024, there were six brands involved in the heavy loader market.

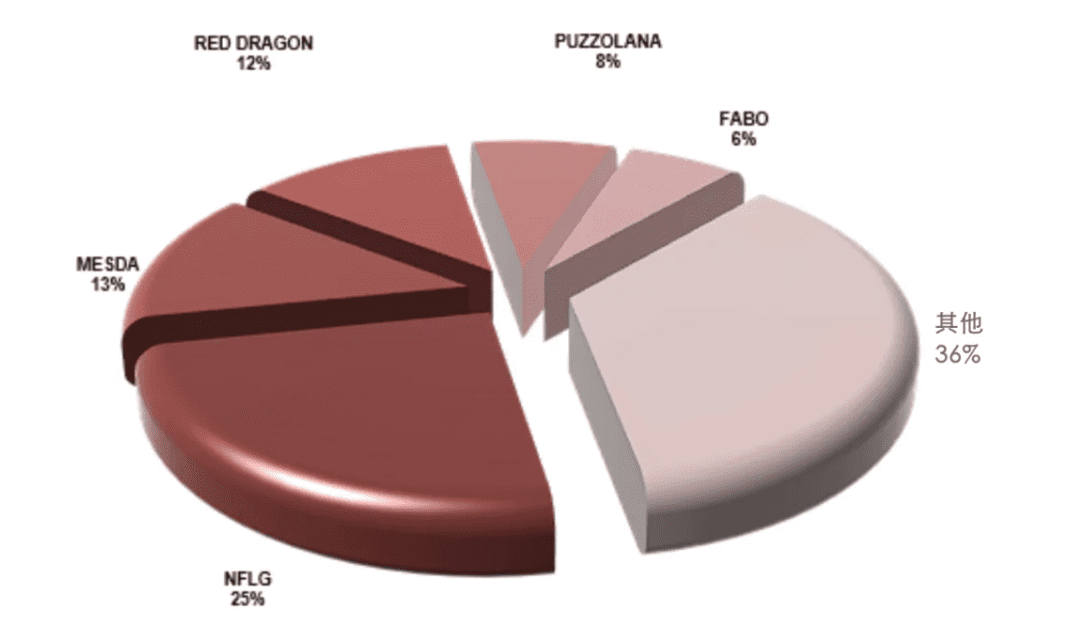

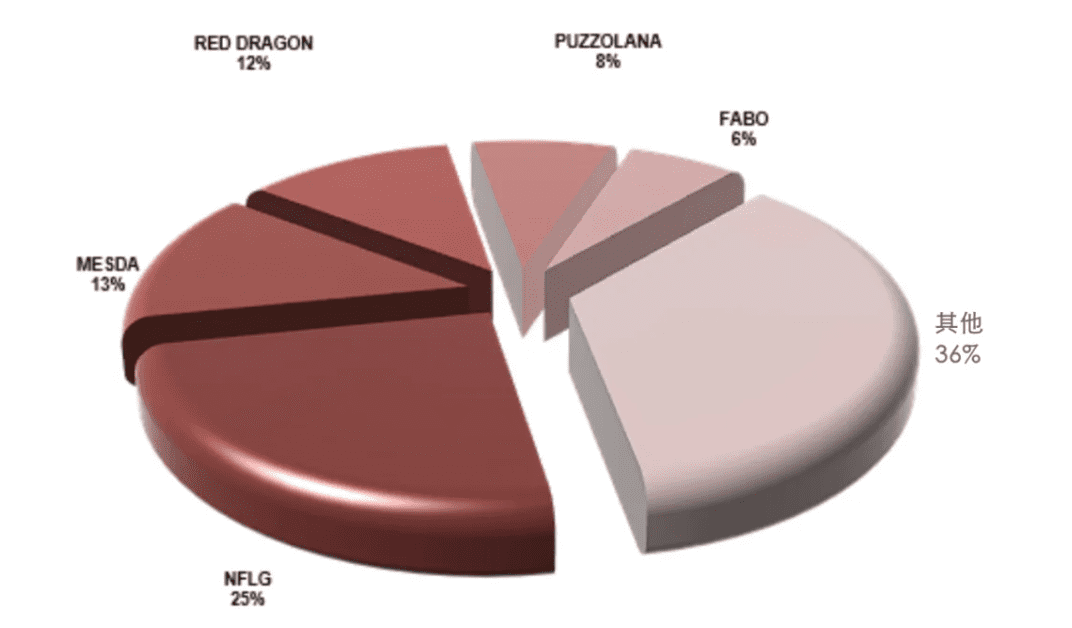

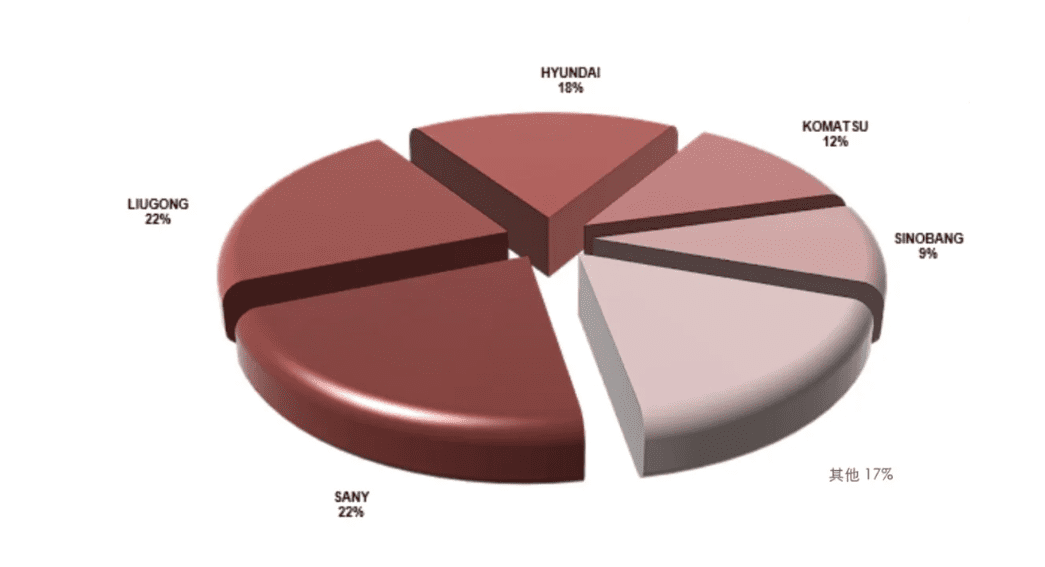

Chinese Brands Occupy 80% of the Crushing and Screening Equipment Market

Self-propelled crushing and screening equipment is one of the most complex and difficult to analyze import markets. Although many brands are involved in this area, major company supplies have significantly dropped. “Currently, Chinese manufacturers hold about 80% of the market share, with a diverse brand structure. In the first half of 2024, there were nearly 20 manufacturers supplying this type of equipment to Russia, with the largest suppliers being NFLG and Mesda. NFLG was previously a well-known supplier of asphalt concrete equipment to the Russian market and began supplying crushing and screening equipment starting in March 2022. Mesda has gradually entered the market, with small-scale supplies starting in 2021.”

Data on Mobile Crushing and Screening Equipment Imports

(Market Share of Brands January-June 2024)

(Import Dynamics from January 2020 to June 2024 — Units/Sets)

Among the top five market participants, two new brands emerged: Red Dragon from China and Puzzolana from India. Lovkov also mentioned that the Turkish brand FABO supplied about eight units of mobile crushing equipment to the Russian market during this period.

Mining Dump Truck Market Grows Nearly 2.5 Times

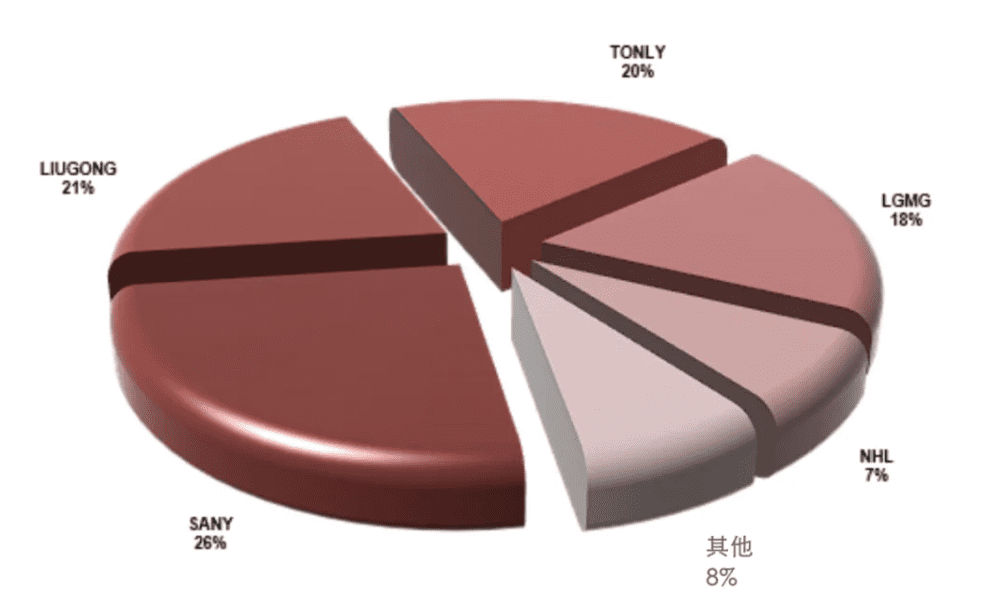

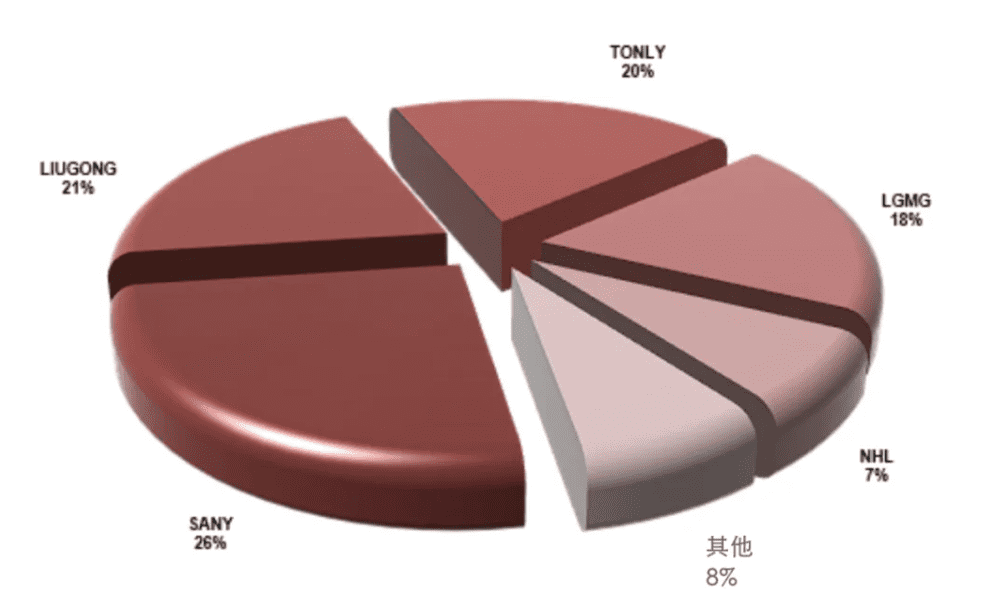

The market for mining dump trucks is one of the few that has continued to grow since the start of special military operations (SVO), with an increase of 138% in 2022. This growth is largely due to imports from friendly country brands, especially as Chinese brands completely replaced suppliers from unfriendly countries, notably Komatsu and Caterpillar completely exited the market. “The market for mining dump trucks is almost entirely dominated by Chinese brands. Import volumes are consistently increasing: there was a 24% increase in 2023 and an expected growth of nearly twofold for 2024,” Lovkov said.

Data on Mining Dump Truck Imports

(Market Share of Brands January-June 2024)

(Import Dynamics from January 2020 to June 2024 — Units/Sets)

BELAZ mining dump trucks from Belarus also held a market share in Russia but have seen a decrease in import volumes since the SVO began. In 2022, BELAZ’s market share was about 53%, 47% in 2023, and it dropped to 25% in the first half of 2024. Komatsu mining dump trucks from the EU also began to enter the Russian market regularly. In conclusion, these submarkets are crucial, considering their specificity and significant potential. Although parallel imports continue, this is no longer sufficient under the current conditions. In the 2.5 years since the SVO, despite some difficulties, trust in Chinese manufacturers in Russia has increased. However, the variety of brands on the market increases the difficulty of ensuring after-sales service and maintenance. Furthermore, new brands from India and Turkey have also begun to appear in the market, Lovkov concluded.

Keywords: