Last week’s Bauma exhibition attracted approximately 600,000 visitors from over 200 countries. Exhibitors and industry leaders generally reported a positive atmosphere at the event, believing this grand occasion could bring substantial momentum to the equipment industry.

Trump Tariffs Become a Hot Topic at the Exhibition

Against the backdrop of the current Trump tariff policies, it’s unsurprising that Road construction equipment manufacturers are focusing on tariff issues (in fact, the situation may have further evolved by the time you read this). Although most exhibitors adopted a “wait-and-see” approach, some companies shared their strategies with International Rental News (IRN) for coping with potential tariff impacts.

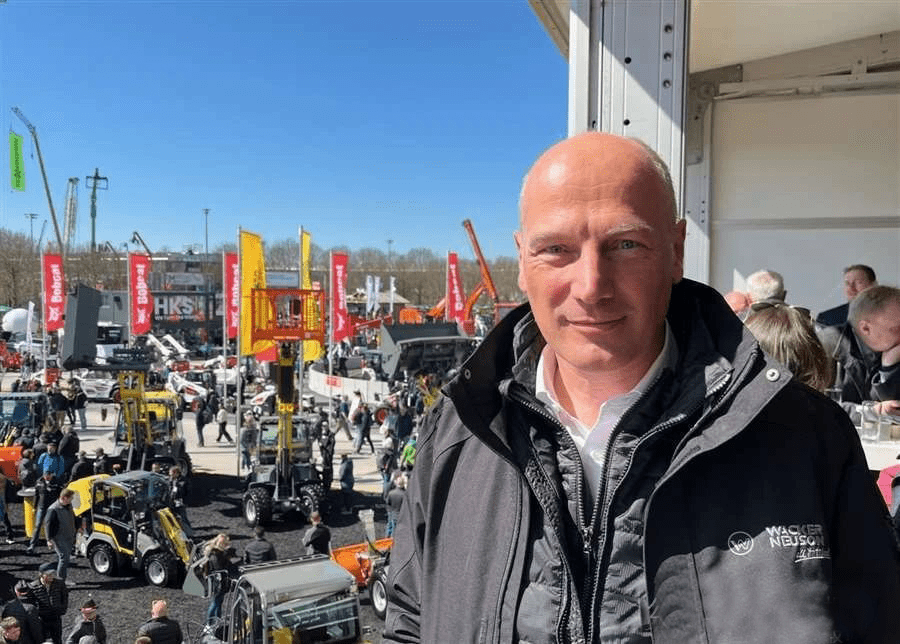

For example, Wacker Neuson revealed plans to accelerate the production of mini excavators in the U.S. in response to the American government’s tariff policies. Alexander Greschner, the company’s Chief Sales Officer, stated that in addition to the originally planned collaboration with John Deere to produce 3-5 ton models, they now intend to manufacture 1.5 to 2.5 ton mini excavators locally in the U.S.

“We will push forward with localization,” he said. “If this is the future trend, we must become more ‘Americanized’… Clearly, Americans now understand that European products may become more expensive. But as a multinational corporation, if we export €500 million worth of products from Europe to the U.S., a 20% tariff would mean a €100 million loss in profits. Without action, this €100 million would directly evaporate from our profits, so we must adopt a global perspective to find other profitable avenues.” However, he acknowledged that customers might face unpredictable price fluctuations, particularly in the U.S. market over the next 9 to 12 months.

Spanish generator and light tower manufacturer Himoinsa is taking a wait-and-see approach, but Cristina Avilles, its Global Marketing and Communications Director, noted that thanks to production bases in both Europe and the U.S., the company has some flexibility to quickly adjust if tariffs are implemented.

Manufacturers Accelerate Localization of Production Bases

Production localization has become a core topic, especially in the aerial work platform sector. Beyond Trump’s tariffs, the European Commission’s decision earlier this year to impose tariffs on self-propelled aerial work platforms imported from China (following similar U.S. tariffs) has prompted manufacturers to reconfigure their production networks.

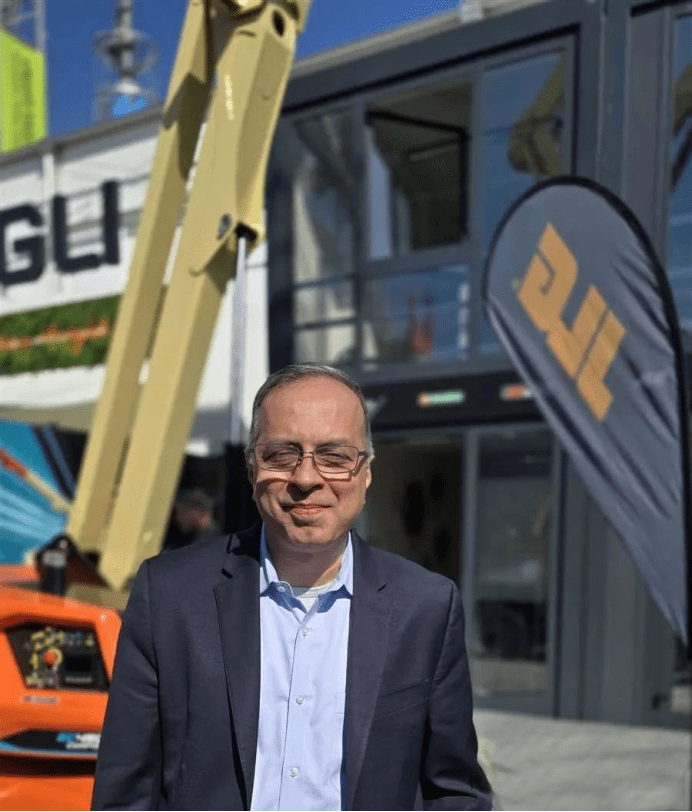

Aerial platform manufacturer JLG recently adjusted its strategy, shifting to a “Made in Europe for Europe” model. Its acquisition of Italian company Hinowa, showcased at its booth, exemplifies this approach. Mahesh Narang, President of JLG and Executive Vice President of parent company Oshkosh Corporation, stated: “The message is clear—if you want to sell in Europe, you must produce in Europe.” He confirmed that JLG has relocated some of its Chinese production capacity to four European factories, including the exhibited EC450AJ compact and EC660AJ rough-terrain electric boom lifts, both developed and produced at Hinowa’s facility. Narang emphasized the minimal investment required for localization: “No major expansion is needed; we just have to adjust warehouse layouts.”

Product prices will also remain stable: “By saving on logistics costs, we’ve balanced the expenses and can offer European-made equipment at the same price.” This model will be expanded globally in the future: “Long-term, products sold in the U.S. will be made there, while Asian market products will be supplied from our Chinese base.”

Chinese company Sinoboom also announced a “Made in Europe” strategy, acquiring Dutch scissor lift expert Holland Lift (which went bankrupt in 2023 due to high costs and supply chain issues). Through its Dutch subsidiary, Sinoboom gained access to Holland Lift’s intellectual property and over 30 models (with working heights of 16-34 meters and load capacities exceeding 1,000 kg), which will be produced at its Polish factory exclusively for the European market.

Xu Xin, CEO of Sinoboom Group, said: “This move helps diversify our products and deepen our presence in Europe.” Zoomlion, meanwhile, invested €100 million in a new Hungarian factory to produce aerial work platforms and plans to enter the U.S. market. Ren Huili, General Manager of Zoomlion’s Aerial Work Machinery Division, revealed that the company is considering acquiring a U.S. manufacturer or building its own facility and has already held talks with at least one supplier.

Automation Technology Takes the Spotlight

While much attention focused on alternative energy, advancements in automated machinery were equally notable.

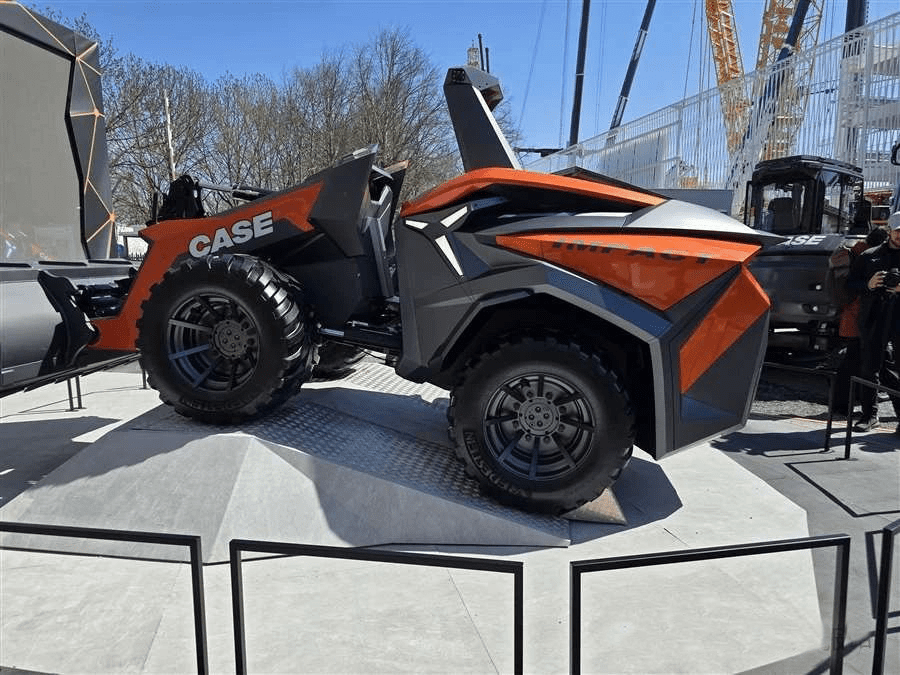

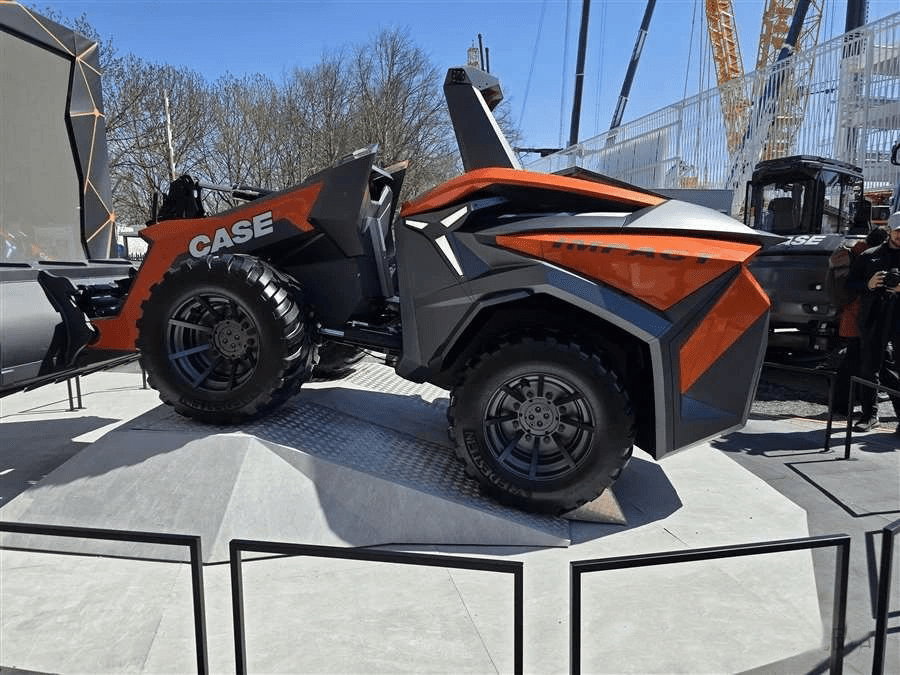

Case Construction showcased a driverless electric compact wheel loader concept. Based on the eCWL 12EV, the “Impact” model eliminates the traditional cab and is operated remotely via a dedicated control room. Its integrated perception system provides real-time assistance for digging and loading, making it suitable for harsh environments or operators with mobility challenges. Although no commercialization timeline was announced, the company confirmed plans for mass production. Hitachi Construction Machinery Europe unveiled the LANDCROS One concept excavator, combining AI with remote operation. It offers three modes—manual (AI-assisted), automatic (for repetitive tasks), and remote—and supports electric, fuel, and hydrogen power systems, aiming to enhance operational intuition through a “phygital” (physical + digital) interface.

HDX (Hyundai Doosan Infracore XiteSolution) announced a collaboration with Gravis Robotics and building materials group Holcim to develop automated equipment for quarries and material handling. The plan involves deploying autonomous technology on HDX’s Develon equipment to improve productivity and safety.

Sustainability Becomes a Core Concern

New energy equipment dominated the exhibition, with manufacturers expanding their product lines to meet diverse needs. Beyond JLG’s electric boom lifts, Skyjack launched its first hybrid electric articulated boom lifts, the SJ45 AJHE+ and SJ60 AJHE+ (with working heights of 15.7m/20.1m), which retain the design features of their electric counterparts.

Chinese companies stood out particularly: Dingli debuted 18/22m scissor lifts with mild hybrid technology, where lithium batteries serve as both starter power and can be recharged by an engine, providing extra torque in complex conditions; XCMG exhibited the hybrid XGA20H articulated boom (diesel range-extended + electric, with 20-day endurance) and the XT2506E lightweight electric telehandler, suitable for enclosed spaces like farms and hospitals; Manitou showcased its hydrogen fuel cell prototype, the MRT 2260 H2 (22m lift/6t capacity), and two electric telehandlers, the MT 1440e/1840e (63kWh battery for all-day operation, with 75% lower operating costs than diesel models).

The most eye-catching exhibit was Bronto Skylift’s world-first 56m fully electric aerial work platform, built on an electric chassis from Volvo subsidiary Designwerk and customized for Swiss cleaning company Rohr.

Strong Demand for In-Person Exhibitions Persists

The past five years have proven that the appeal of face-to-face exhibitions remains irreplaceable. Although digital alternatives gained traction during the pandemic, Bauma 2025 reaffirmed the unique value of physical events in building relationships, exchanging ideas, and experiencing technology firsthand. Stefan Rummel, CEO of Messe München, summarized: “The 600,000 visitors from over 200 countries confirm that Bauma is the industry’s pulse and a critical nexus for global trade. This event sends a strong signal of confidence to the entire sector.”

Keywords: