Disclaimer: this article was original published by Machinery Intelligence Station.

Sources: https://mp.weixin.qq.com/s/w9a8WiDv8htNGw08Nm3Exg. This article is compiled from summaries of public reports by foreign media.

Following the continuous release of statistics for cranes, excavators, bulldozers, and loaders in Russia for the year 2024, let’s now talk about backhoe loaders. The statistics cover production data from Q1 to Q3 of 2024 (full-year data has not yet been published), while import data provides statistics for the first half of the year. (The article is authored by Russian blogger “Engineering Machinery and Transportation Channel,” with a summary compiled by Machinery Intelligence Station)

Domestic Production Situation in Russia

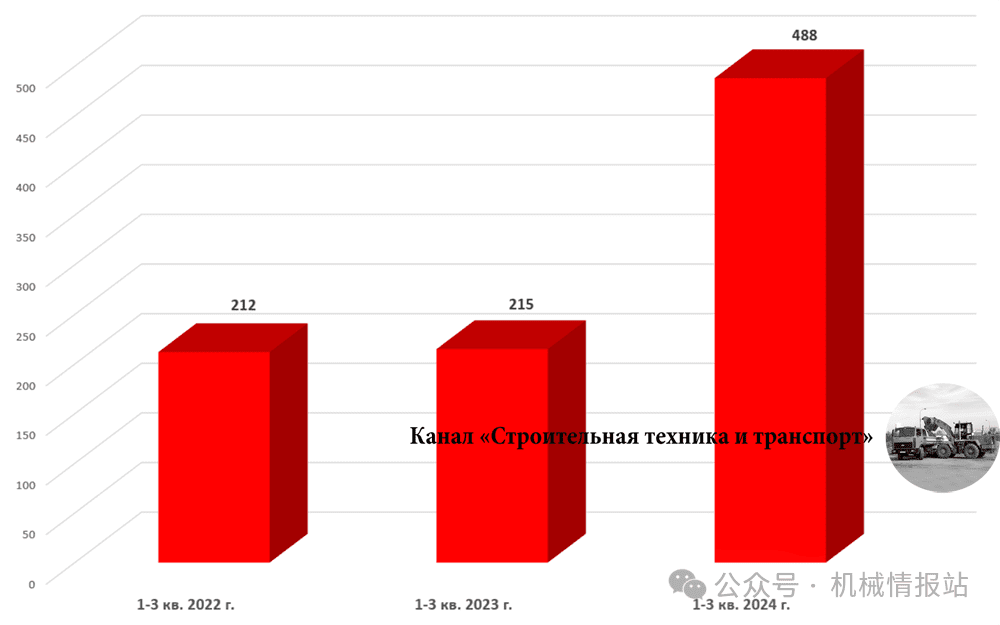

From the first to the third quarter of 2024, the output of backhoe loaders in Russia increased by 2.2 times compared to the same period in 2023: a total of 488 machines were produced in the first nine months. Although imports declined in 2024, the market share of domestic companies increased from 3% to 6% (data for the first half of the year), whereas in 2022, the market share for domestic products was 14%.

With the onset of the special military operation, the production of UMG (formerly Terex) backhoe loaders by the Tver Excavator Plant was temporarily halted due to the lack of imported components. It took a year and a half to address the issue of substituting unavailable components. It was not until the fourth quarter of 2023 that the factory successfully resumed production using substitute parts. In the first to third quarters of 2024, TVEX assembled 188 machines.

From January to September 2024, ElAZ increased its output: during this period, 229 localized backhoe loaders (formerly Cukurova Makina) were produced, a 1.8-fold increase from the same period in 2023.

Russian Domestic Backhoe Loader Production Statistics from Q1-Q3 for 2022-2024

The Cherepovets Foundry and Mechanical Plant, which manufactures backhoe loaders authorized by the Belarusian company “Dorelektromash,” saw an 11% decrease in production, assembling a total of 71 pieces of equipment. Most of the machines produced are attachment equipment for the MTZ-82 agricultural tractor. Previously, specialized tractor-type chassis models constituted a large portion of the production plans.

Regarding the new backhoe loader manufacturer AGB Construction Machinery in the Moscow region, statistics have not yet been published. The project started in 2022, producing a model similar to the JCB 3CX Super. According to factory representatives, the production of metal structures is fully mastered using imported components, with sales commencing in 2023. An annual production of approximately 50 units is expected.

Backhoe Loader Import Situation

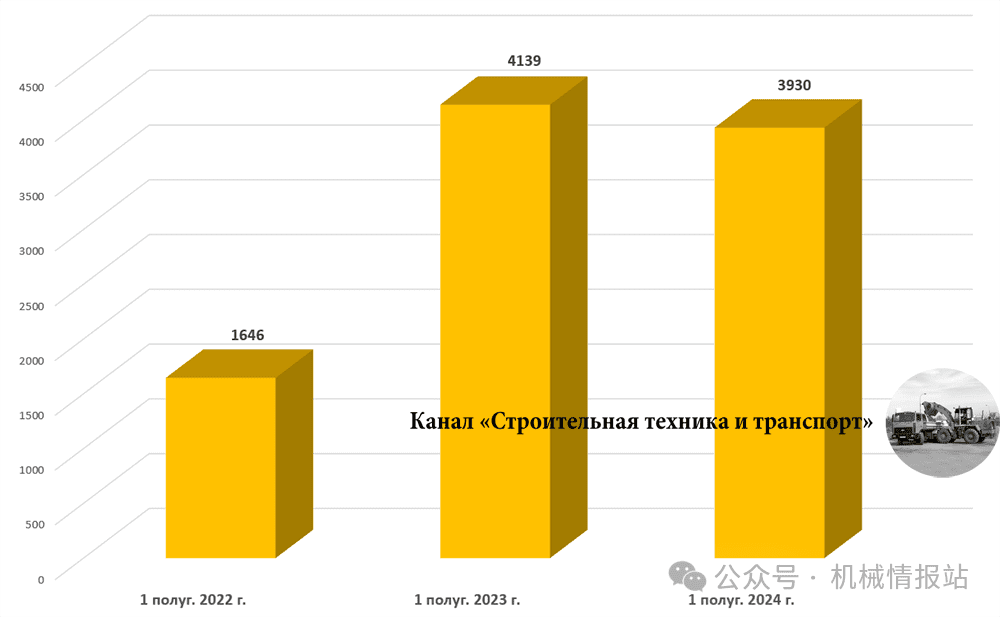

The import volume of backhoe loaders has dropped slightly: 3930 units were imported in the first half of 2024, a 5% decrease from the corresponding period in 2023. In contrast, the import volume in 2023 had tripled compared to the same period in 2022 (4139 units).

Western brands, which once led the Russian market, were replaced by Chinese brands from 2022, many of which were completely unknown in Russia. The top five import volumes were: Shanmon—567 units (up 68%), Liugong—393 units (up 3 times), Sany—283 units (up 94 times), LGCE—176 units (there were no imports in the first half of 2023), and XCMG—160 units (up 6.4 times). Additionally, 945 units from other unknown Chinese brands were declared.

In 2022, Indian brand backhoe loaders appeared on the Russian market for the first time. In the first half of 2023, imports of Indian brands increased to 500 units. However, the results for 2024 were unexpectedly low: only 56 units from the Amir brand and 54 units from the ACE brand were imported in the first six months.

The import volume for Turkish brands was higher, despite a decrease: Hidromek—358 units (down 19%), Cukurova—321 units (down 33%), and MST—211 units (down 10%).

Among Western brands, JCB and Case were the most notable, importing 214 and 155 units, respectively.

From January to June 2024, 16 used backhoe loaders were declared, compared to 44 units in the same period of 2023.

Half Yearly Russian Import Backhoe Loader Statistics for 2022-2024

Background Reference

Looking back at Russia’s backhoe loader market, it is worth noting that during the 1990s-2000s, the main demand was for domestic machines based on agricultural tractor chassis (MTZ, YuMZ, LTZ, VTZ). Many enterprises produced such machines—SAREX, ZLATEX, Inter-Don, ElAZ, Donetsk Excavator Factory, LEX, Omsktransmash, ChZKM, and others. During the peak of the construction boom in 2007 and 2008, these manufacturers produced about 2500 machines per year combined.

In the 2010s decade, the production of backhoe loaders based on agricultural tractor chassis almost ceased. Today, all the above-mentioned factories have ceased production of such excavators for various reasons, some have gone bankrupt, while others have transitioned to other products.

Between 1990-2010, some Russian manufacturers attempted to develop backhoe loaders based on their designs for specialized tractor chassis. Unfortunately, these machines did not achieve mass production. The only viable business model was the introduction of foreign backhoe loaders for localized production. However, despite mastering more modern machinery, domestic Russian companies have not been able to reach the peak production of the 2000s boom years.

Keywords: