Disclaimer: This article was Original published by Mechanical Intelligence Station, the material in this article comes from a summary compilation of open reports from foreign media, and the views expressed do not represent this station. We welcome submissions and collaborations.

Over the past two years, the price of new mini excavators in Russia has increased by up to 130%. The data in this article are based on the latest quoted advertisements published on major Russian internet platforms in January 2025, supplemented by information from official dealer websites. When sellers link equipment prices to the current US dollar or euro exchange rate, the monthly average ruble exchange rate will be used for calculation. (Excerpt translation from Russia Construction Machinery Network)

Supply quantity of new and second-hand mini excavators across Russian regions:

In the field of new equipment, the top three regions by supply quantity are the Central Federal District (24%), Volga Federal District (19%), and Siberian Federal District (12%). The Ural Federal District and the Southern Federal District, ranked fourth and fifth, are very close to the third place.

In the second-hand mini excavator market, the Far Eastern Federal District leads: due to a large number of equipment being imported from Japanese auctions, the region accounts for as much as 46%. This is followed by the Central Federal District (12%) and Southern Federal District (11%).

Comparison of the top 8 Russian mini excavator suppliers (New on the left, Second-hand on the right)

Supply structure: Brand and equipment age

Over 85% of the new equipment sales quote ads come from China. Other countries offering products in the Russian market include Russia (6%), Japan (5%, parallel imports), and South Korea (3%).

The situation is different for second-hand mini excavators: over 79% of the supply still comes from Japanese brands, while Chinese brands only account for 10%.

Proportion of brand equipment quote ads from different countries and regions (New on the left, Second-hand on the right)

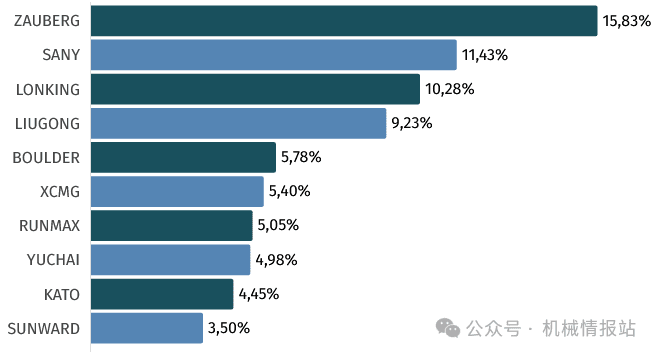

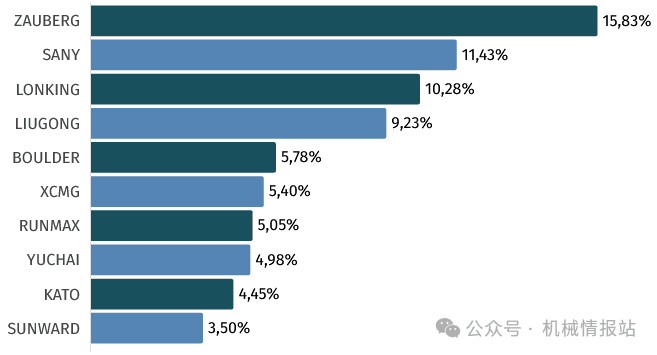

In the field of new equipment, the Zauberg brand’s suppliers are the most active: this Chinese brand accounts for 16% of the total supply. Nearly 50 Chinese brands offer mini excavators, with 7 entering the top ten. The top ten also include 1 Russian brand and 2 Japanese brands.

Top 10 brands for mini excavator sales ads (new equipment)

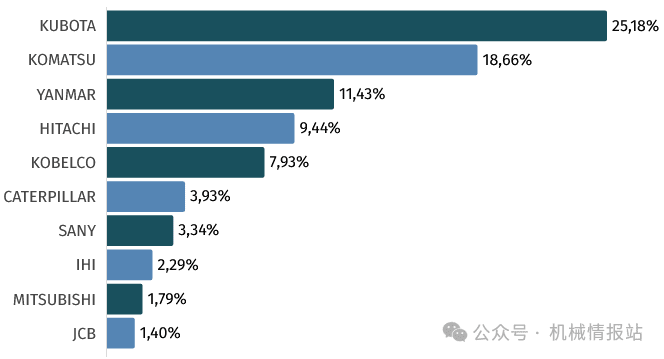

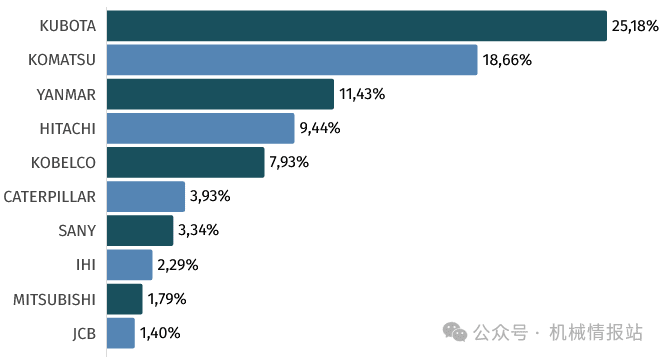

In the second-hand equipment market ranking, Japanese brands also occupy 7 positions.

Top 10 brands for mini excavator sales ads (second-hand equipment)

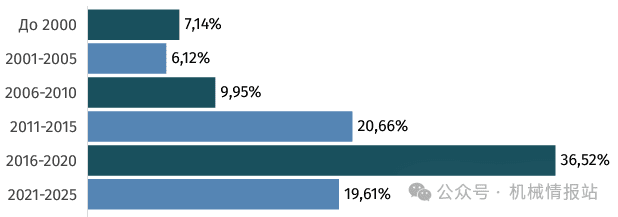

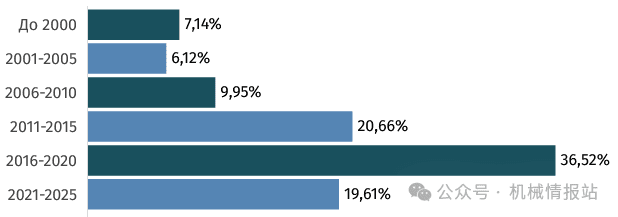

More than a third of second-hand equipment sales ads (about 37%) are for equipment produced between 2016-2020. Mini loaders older than 15 years make up only 23% of the total.

Structure of quotes by production year (second-hand equipment)

Price issue: Price of mini excavators based on the region of manufacture and year of production

The final data suggest that in the past 2-2.5 years, the prices of Russian-made mini excavators have experienced the most significant increase. However, a detailed analysis indicates that the main reason for this price increase is the wider range of supply. If the last calculation included more low-end models closer to the lower price range, now there is a selection of equipment from different quality categories.

Nonetheless, among all producing countries, Chinese brands have been the most effective in controlling prices. Particularly in the 2-4 ton class, the prices of Chinese equipment have risen by an average of only 10%.

In the 4-6 ton class, there were not enough Russian equipment supplies found to calculate.

Second-hand equipment market prices typically depend on the condition of the equipment being sold. However, price increases for Japanese equipment are clearly above the average. Depending on the category of excavator, the prices for Japanese equipment increased by 36-81%.

A specific model price analysis confirms that the price changes for new Russian equipment are not so dramatic: The price of the Boulder EX10 mini excavator increased by 25% (not a doubling).

In the second-hand equipment market, the price of the Japan-made Kubota RX-306 mini excavator has risen by over 70%. Meanwhile, the average price for the Japanese brand Yanmar B3 has only increased by 30%.

In January 2025, when looking for the “older and cheaper” category of second-hand mini excavators, buyers may turn their attention to Japanese equipment, as well as European and American ones. At the same time, Korean excavators over 15 years old are almost absent in classified ads, while Chinese equipment is mainly concentrated on models after 2020.

Finally, it is worth noting that although Chinese brands dominate the new equipment market, buyers still have options from different brands. Overall, when choosing models to renew their own fleet, supply of parts and quality after-sales service become the primary criteria. Remember that maintenance and repair issues may arise not only with equipment purchased through parallel imports but also when working with lesser-known Chinese brands that cannot provide adequate technical support.

Keywords: