Disclaimer: This article was Original published by Machinery Intelligence Station. This article is a summary compilation from foreign media public reports, and the viewpoints within do not represent this station. Contributions and collaborations are welcome.

This article analyzes statistical data for the most popular excavators on the Russian market (with operating weights ranging from 12 to 70 tons). Data is from the first to the third quarter of 2024 (full-year data is not yet released), and import figures are for the first half of 2024. In fact, even these figures clearly illustrate the market trends that are unfolding. (The article is authored by a Russian blogger “Construction Machinery and Transport Channel,” summarized and compiled by the Machinery Intelligence Station).

First, let’s review the market changes. Between 2022-2023, the Russian excavator market experienced unprecedented growth. In 2022, market sales surpassed the historical peak of 2008, and in 2023 it set a post-Soviet record — 11,766 units (combined production and imports for the first to the third quarter), a 55% increase over the same period in 2022, which was more than double the same period in 2021.

However, in 2024, the excavator market growth trend reversed, showing a negative growth, with a significant decline in imports. The primary reasons were the high-interest rates maintained by the Russian Central Bank, leading to reduced investment in the construction industry by the state and private sectors. Moreover, the depreciation of the Ruble, especially against the rising value of the Chinese Yuan, further exacerbated this trend. New sanctions made international payments still problematic, further suppressing market growth. (If you are also experiencing payment issues in your business with Russia, please contact the Machinery Intelligence Station, see the poster at the end of the article for details.)

To protect the Russian market, the “Association of Specialized Machinery” proposed strengthening government technical supervision of products and urged tighter controls on the certification of importers. The association also supports the government’s decision to gradually increase the scrappage tax rate for old machinery, with plans to incrementally raise the rate over the long term. Particularly from January 1, 2025, the scrappage tax rate for road construction machinery will increase by 15%, with annual adjustments thereafter.

The Ministry of Industry and Trade of Russia noted that the scrappage tax for excavators and backhoe loaders will start increasing in 2026 and 2028 respectively, as the production of these machines in Russia is “still in its initial stages.” This statement is somewhat surprising, considering that during the Soviet period, and even in the 1990s, Russia’s mechanical engineering industry was almost able to meet domestic demands for excavators.

But from the 2000s to the 2010s, Russia closed several major excavator manufacturing plants, including in Kovrov, Voronezh, Krasnoyarsk, and Donetsk, and the Uralvagonzavod also ceased production of excavators, resulting in a significant decline in Russia’s excavator manufacturing capabilities. Today the production scale of Russian-made excavators has significantly reduced, falling from a market share of 70% in the early 2000s to 5% in 2023.

2024 Domestic Production in Russia

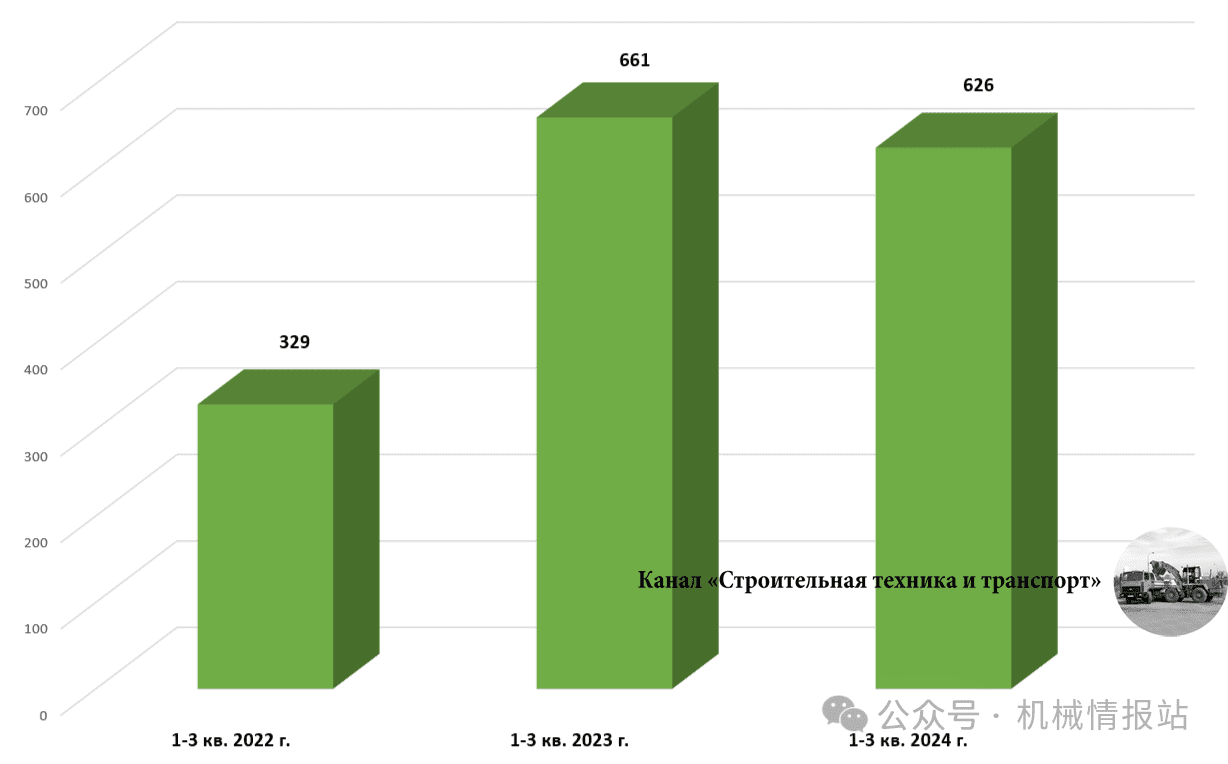

In 2024, excavator production in Russia saw a decline: a total of 626 units were produced in the first to third quarters, a 5% decrease compared to the same period in 2023. Nevertheless, due to the drop in imports, the market share of domestic factories increased from 5% in 2023 to 12% in the first half of 2024.

UMG Group’s “Tula Excavator Plant” produced 356 excavators from January to September 2024, a 5% increase from the previous year. Another factory of the group, “Eksmash,” produced 223 units, a 15% decrease from the same period in 2023. It is worth noting that since the start of the Special Military Operation (SVO), Tula’s two factories lost access to Western components, and production came to a halt at one point. In spring 2022, Tula Excavator Plant had to temporarily resume production of the old 90s-designed wheeled excavators EK-14 and EK-18, which used Russian-made parts. However, in the second half of 2022, the factory successfully resumed the production of modern 23-ton crawler excavators and replaced “unfriendly” country parts with Chinese “sanction-resistant” components. Between 2023 and 2024, the Tula Excavator Plant added several “import substitution” excavator models, while older models with less market demand ceased production.

“Kranex” factory produced 47 excavators in the first to third quarter of 2024, a 23% decrease from last year. Notably, at the end of 2022, Kranex announced the official launch of a modernized excavator series produced in cooperation with a Chinese partner. Currently, the Ivanovo factory not only produces its own brand of excavators but also manufactures excavators for Russian partners under the “CHETRA” and “DST-Ural” brands.

Over the past decade, Kranex mainly produced metal components for excavators for Russian factories (such as Komatsu, Hitachi, and Caterpillar) while its own production of excavators steadily decreased, even dropping to single digits at times.

Russian Excavator Production Dynamics for Q1-Q3 of 2022-2024

2024 Imports

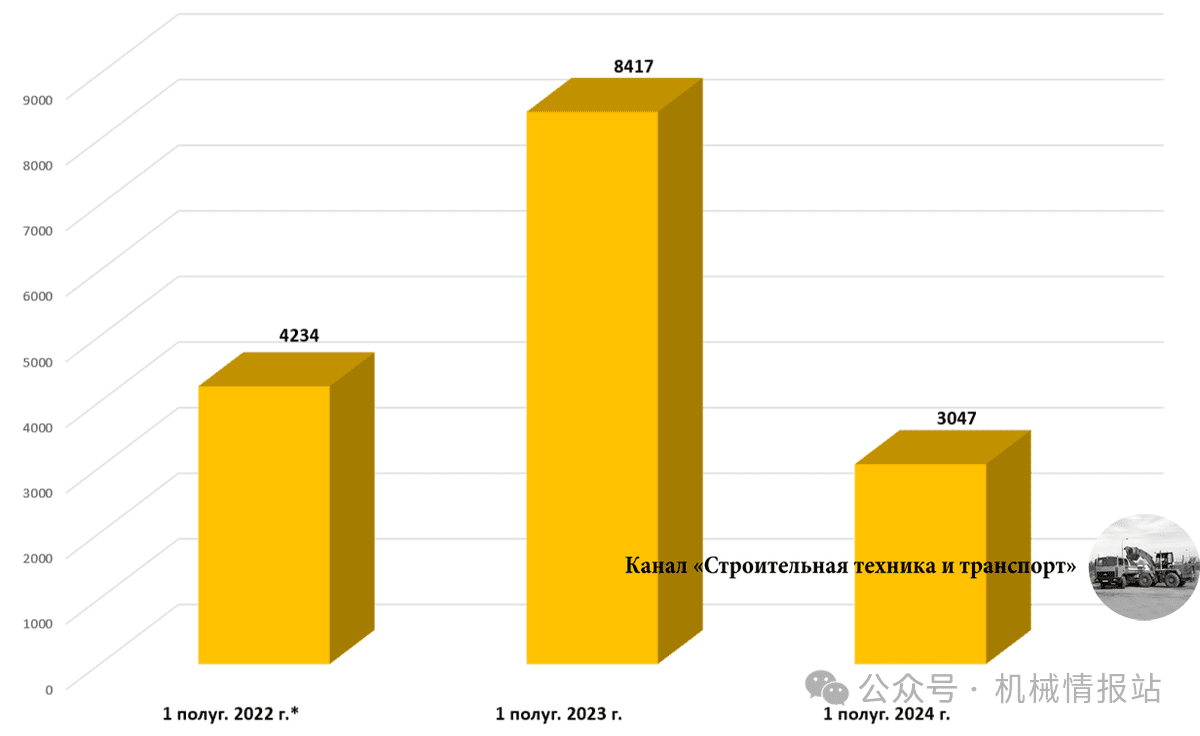

After the explosive growth in 2022-2023, imports of excavators in the first half of 2024 significantly decreased. Total imports for the first half of 2024 were 3,047 units, almost a third of the previous year’s same period. Particularly, imports from Chinese and South Korean brands decreased significantly, with almost no imports from “unfriendly country” manufacturers.

The top five import brands from January to June 2024 were: Sany with 623 units (down 55%), Shantui with 354 units (up 27%), Lovol with 304 units (up 11%), LGCE (formerly SDLG) with 263 units (down 76%), and XCMG with 218 units (down 84%). Additionally, LiuGong with 172 units (down 78%), Sunward with 120 units (down 37%), and Lonking with 101 units (down 67%) also showed significant declines in imports.

There were dozens of other Chinese brand excavators, totaling 240 imports. In the first half of 2024, although dozens of such machines were imported in the same period of 2023, no Kranex and CHETRA brand excavators were delivered from China.

It should be noted that since the mid-2000s, Chinese excavator imports into Russia’s market have gradually increased, with virtually no imports initially. Since 2020, import volumes have rapidly grown, reaching a peak in 2023. Now, dealers who have stocked up a significant number of Chinese excavators will have enough inventory to supply the market for the next few years.

South Korean brands also performed poorly in the first half of 2024: Hyundai with 253 units (down 66%) and Doosan with 247 units (down 68%).

Imports of other brands of excavators, including “unfriendly” brands (such as Caterpillar, Hitachi, JCB, Kubota, and Volvo, etc.), amounted to 66 units. Before the Special Military Operation, these excavators were produced in Russia at foreign-owned plants like Komatsu, Hitachi, Caterpillar, etc.

In the first half of 2024, the import volume of used excavators was 45 units, an increase of 6 units over the previous year.

Dynamics of New Excavator Imports into Russia for the First Half of 2022, 2023, and 2024

Keywords: